Chapter 1: “Mr. Talwar's Uncertain Future”

Mr. Talwar, a fifty-year old salaryman with a net worth of 45 million

(4.51 crores), was sitting alone in the dark on the balcony of his

apartment in NOIDA with his favourite single malt, worrying about his

uncertain future.

The next morning, with help from Suave Financial Advisor Nikhil and his

laptop “with a 'financial planning' software package”, Mr. Talwar

finally enumerated his financial goals.

| Goal

| Year

| Present cost (lakhs)

|

| Akanksha's higher education | 2021 | 80

|

| Ronit's higher education | 2025 | 80

|

| Akanksha's wedding | 2024 | 70

|

| Ronit's wedding | 2028 | 70

|

| Buying a holiday home | 2027 | 100

|

| Buying a car | Every three years | 10

|

| International vacation | Every year | 5

|

The Software showed “the devastating effect inflation would have” on

these costs. For example, Akanksha's wedding “would cost Rs. 1.2 crore

in 2024, assuming an inflation rate of 8 per cent”. Mr. Talwar, head

held in his hands, was forced to give up on his holiday home altogether,

and cut down on vacations and car changes too.

That left a modest (and remarkably equitable, for a son and a daughter)

target of 15 million (1.5 crores) per child, which Nikhil calculated

could be achieved by investing in equities with a 16% annual return.

Since the BSE Sensex “has delivered a compounded annual return of 15.8%”

since its inception in 1979, no further adjustments were necessary.

Mr. Talwar “swore to become a patient and disciplined equity investor”,

leaving Nikhil free for his next meeting with Mr. Sanghvi (a fifty-five

year old businessman, also in NOIDA, with a net worth of 250 million,

but not a single coffee can to his name).

What is a coffee can?

Nowhere in its three hundred and sixty-odd pages does “Coffee Can

Investing” (by Saurabh Mukherjea, Rakshit Ranjan, and Pranab Uniyal;

Penguin 2018) take the trouble to answer this question with a picture;

one of many disappointments in a book that promises “The Low-risk Road

to Stupendous Wealth”.

Robert Kirby introduced the term

“Coffee Can portfolio”

in a 1984 article where he argues that “You can make more money being

passively active than actively passive”. The latter is a reference to

index fund investing, which Kirby was not a fan of (but this book does

recommend investing in low-cost index ETFs).

The Coffee Can portfolio concept harkens back to the Old West, when

people put their valuable possessions in a coffee can and kept it under

the mattress. That coffee can involved no transaction costs,

administrative costs, or any other costs.

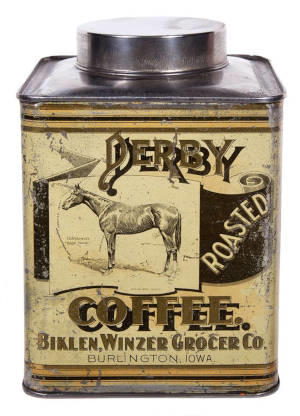

Here is a photograph of an antique coffee can, clearly showing the lack

of administrative costs.

Here is another

Frontier coffee can on sale for $962.50,

which goes to show that the can also appreciates nicely in value if you

keep it under the mattress for long enough.

Stupendous wealth eludes me

I never quite got over the casual acceptance of Mr. Talwar's plans to

spend 28 million (2.83 crores, adjusted for inflation at 8% over present

costs) on his children's weddings, let alone the glib assumption of a

16% compounding annual return on his investments to meet this need in

just seven years. I didn't even manage to get to Mr. Sanghvi's troubles

with replacing his luxury German cars on a regular schedule.

It does not surprise me to learn that all three authors worked at a firm

that offers a percentage-based Portfolio Management Service (and now has

a portfolio “built in pursuit of 10X earnings growth” alongside the

coffee can portfolio). Two have gone on to start another investment

company that also offers a coffee can portfolio.

If your pursuit of stupendous wealth is dedicated enough to make it all

the way through several chapters of canny analysis of which companies to

invest in, you may also enjoy this Economic Times article from earlier

this month:

“Saurabh Mukherjea admits making two mistakes in his widely-tracked portfolio”.

Better yet, read this

article about Cowboy Coffee

for a real "Old West" perspective on coffee-making (and don't miss the

photograph of a carbine with a coffee grinder built in to the butt

stock).